Page 1

LILAC Document Help

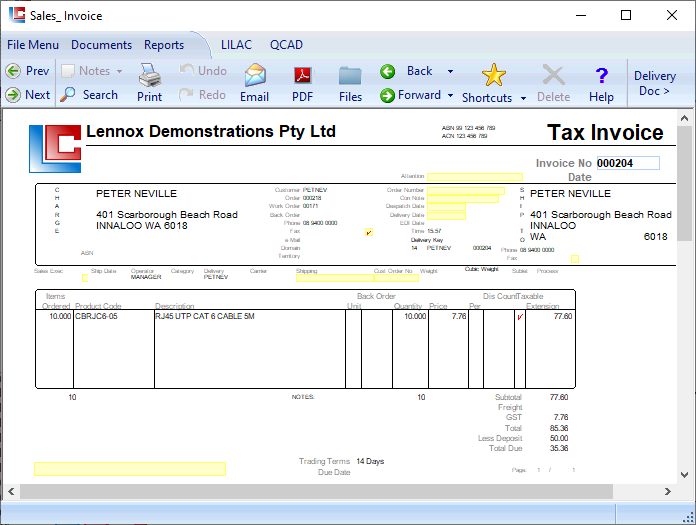

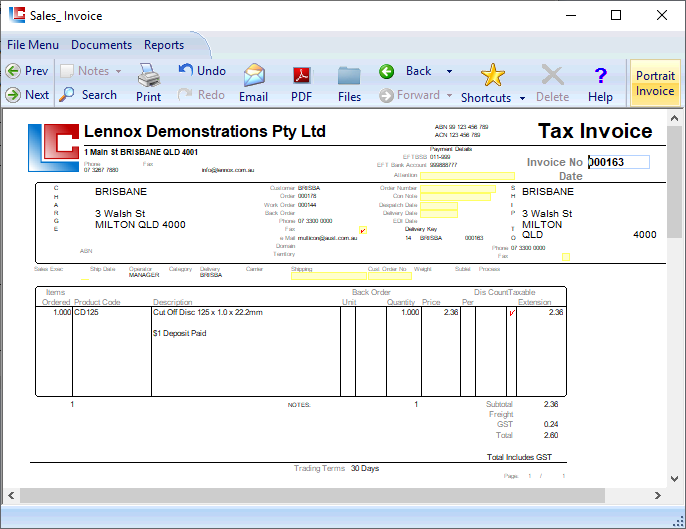

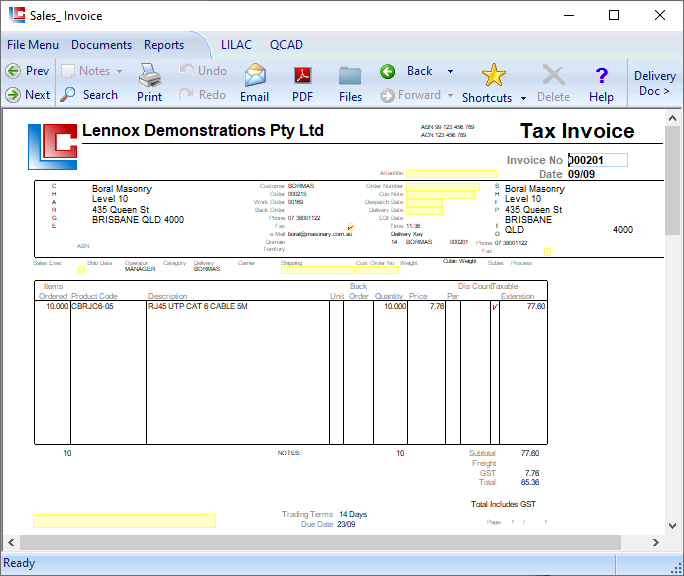

Tax Invoice

Depending on setup, a Tax Invoice can be generated directly - Sales Order > Tax Invoice

Or, via a Work Order (Picking Slip / Manufacturing Card) - Sales Order > Work Order > Tax Invoice.

Tax Invoices (& Credits) are not modified by the operator for audit integrity.

The generation of a Tax Invoice concludes sales order processing. Accounting entries are posted to the general ledger.

Or, via a Work Order (Picking Slip / Manufacturing Card) - Sales Order > Work Order > Tax Invoice.

Tax Invoices (& Credits) are not modified by the operator for audit integrity.

The generation of a Tax Invoice concludes sales order processing. Accounting entries are posted to the general ledger.

Invoices are stored and retrieved by a single key, Invoice No, up to a maximum 8 characters.

To find the latest invoice, right click in the Invoice No field - and strike the 'End' button on the keyboard. Or, Reports > Documents > Invoices.

To find the latest invoice, right click in the Invoice No field - and strike the 'End' button on the keyboard. Or, Reports > Documents > Invoices.

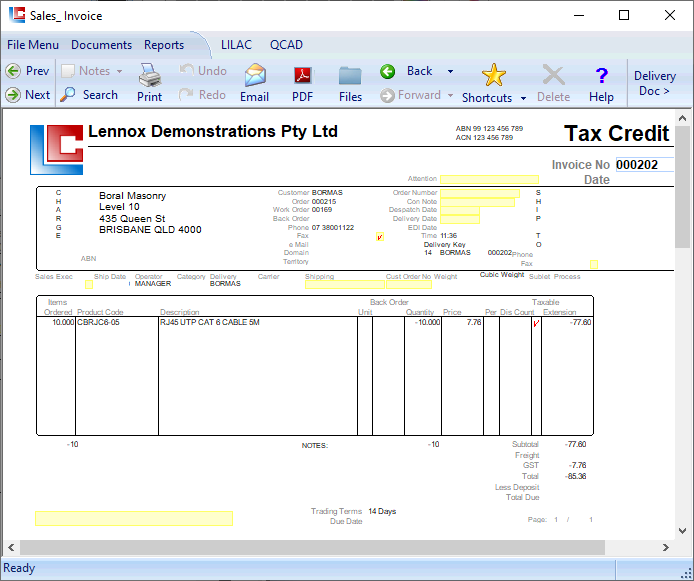

Reverse from the ribbon will reverse / undo all of the accounting entries, generating a Tax Credit document for audit purposes. (See next page).

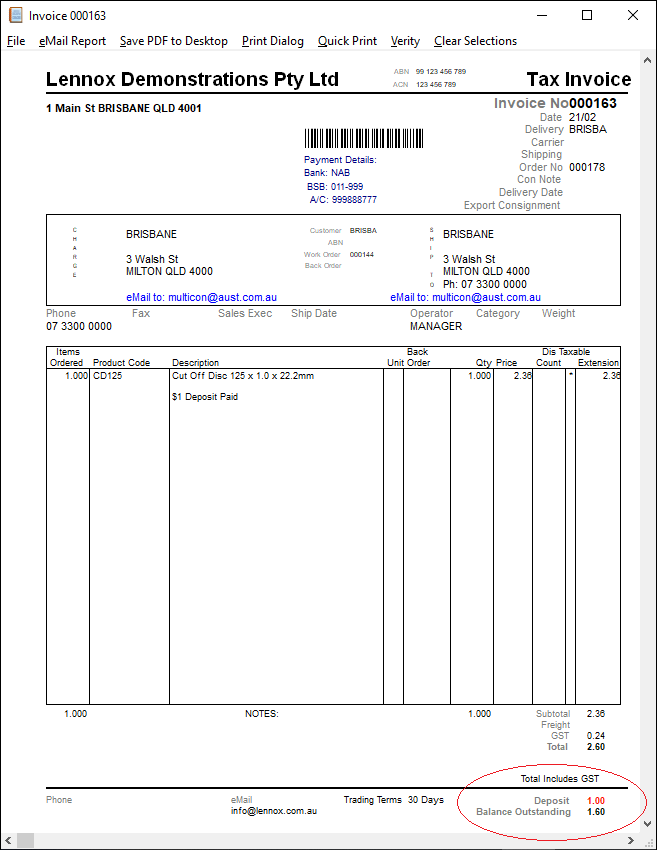

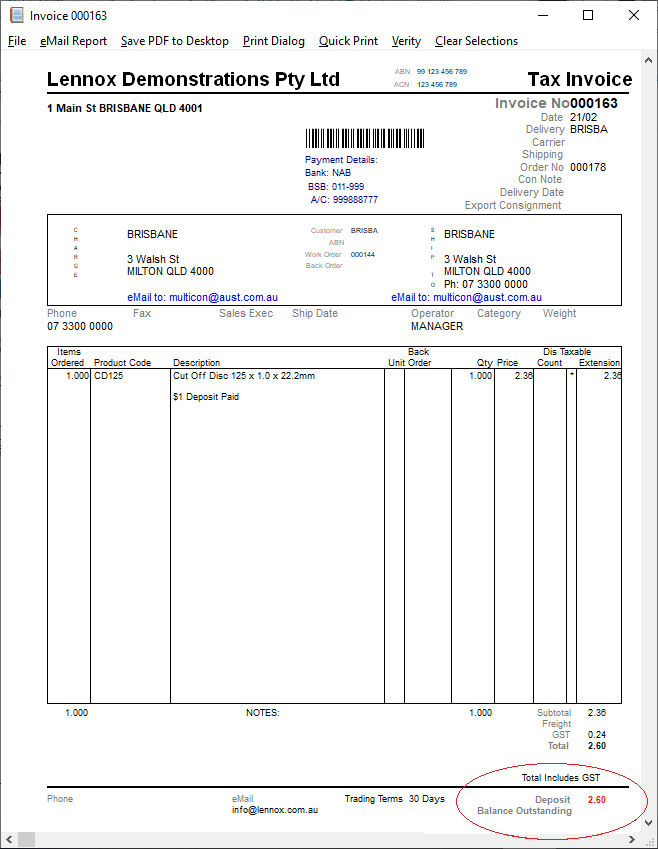

*An alternative Portrait Invoice presentation is available from the ribbon or via: Reports > Documents > Portrait Invoices.

Pro-forma invoices are available from the ribbon of the Sales Order document.

Pro-forma invoices are available from the ribbon of the Sales Order document.

A standard note may be added to appear on each invoice. Documents > Parameters > Invoice Note.

Free text space.

Set trading terms via Debtor Account.

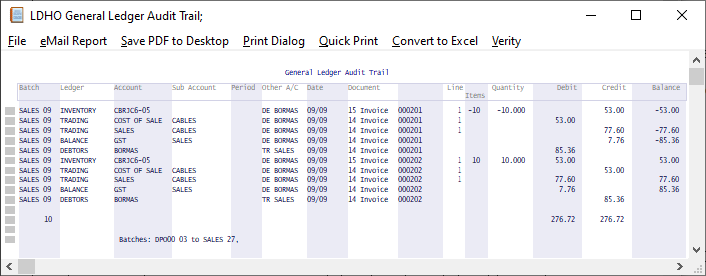

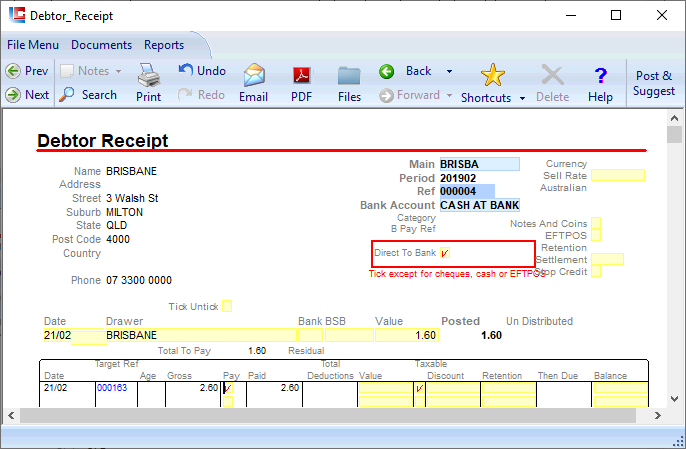

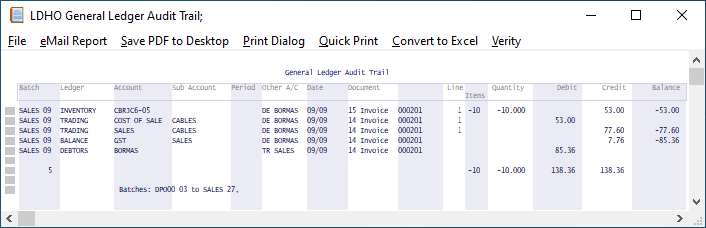

To see postings for Invoice 000201, Reports > General Ledger > Audit Trail, enter 000201 into the From Document field and click 'Report'.

COST OF SALES and SALES are sub accounted by the Product Group, in this example CABLES.

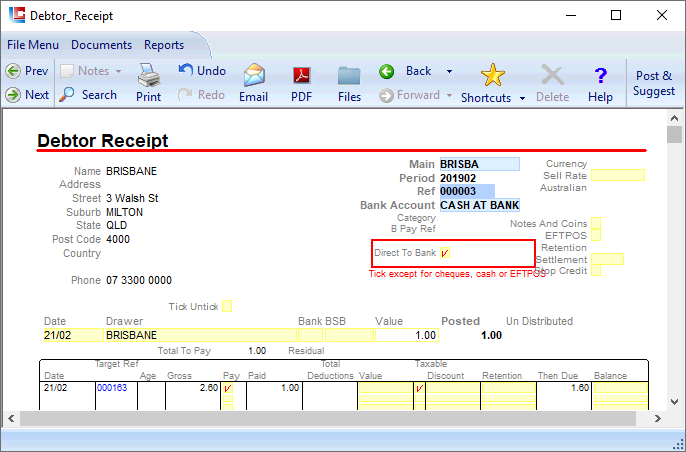

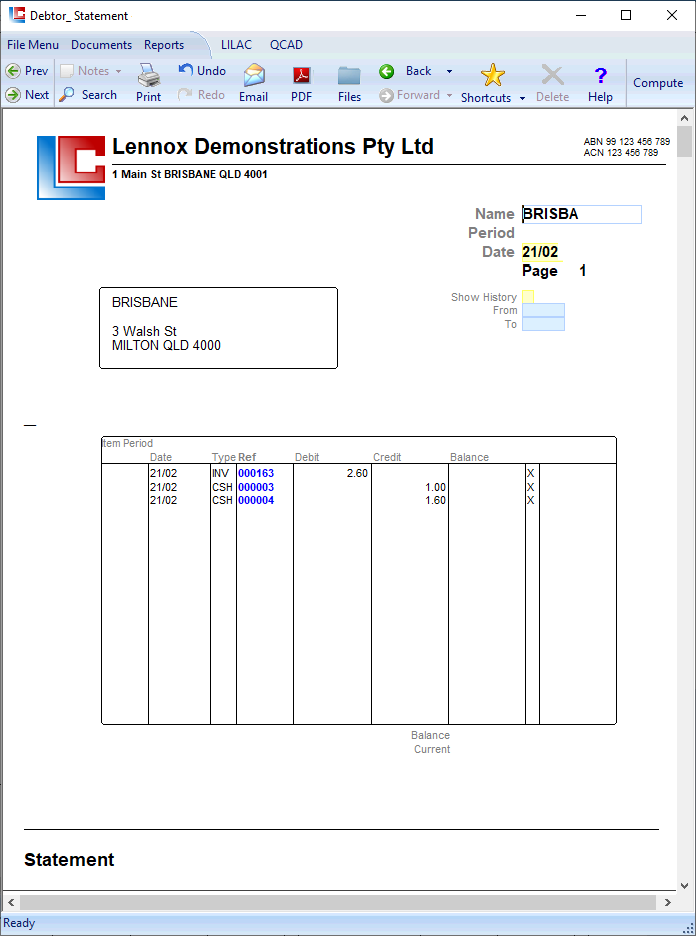

List and drill down to Sales Orders and Invoices

Reports > Status > Sales Document Trail

Reports > Sales Analysis > Sales Order History

Reports > Documents > Invoices

Reports > Sales Analysis > Sales Order History

Reports > Documents > Invoices